To place extra cash during the financial institution. You are able to convert residence equity into funds having a income-out refinance, and set the extra money towards economical goals or home improvements.

On the whole, When you've got higher scores, you’re additional prone to qualify for some credit playing cards. But if your credit is reasonable or poor, your choices will probably be more minimal and you could possibly get a decrease credit Restrict and better curiosity level.

Your lender also may possibly acquire an extra quantity each month to put into escrow, cash that the lender (or servicer) then ordinarily pays straight to the neighborhood house tax collector and in your insurance policy copyright.

Choices require danger and therefore are not well suited for all traders. Evaluate the Attributes and Risks of Standardized Options brochure before you decide to begin buying and selling selections. Options traders may drop your complete level of their financial investment or maybe more in a relatively brief stretch of time.

Its proprietary personal loan engines speedily figure out the personal loan selections that gives you the greatest prospective Expense and/or time savings depending on the knowledge it collects.

A credit score of 740 or better will typically get you the lowest level provides. Lenders also are inclined to supply lessen rates should you make a greater down payment on an individual-relatives dwelling in comparison to a two- to four-unit or manufactured house.

Common annual rates commonly Value under 1% of the home cost and protect your legal responsibility since the home operator and insure in opposition to hazards, decline, and so forth.

Corporations are also judged by credit rating agencies, like Moody's and Common and Lousy's, and specified letter-quality scores, symbolizing the company's evaluation of their fiscal energy. People scores are carefully watched by bond investors and can impact the amount of fascination firms will have to supply as a way to here borrow funds.

Pre-acceptance is going to be a lot more exact to the scenario, but will lessen your credit score a little and can take a lot more effort.

In lieu of concentrate on your specific scores (which change typically), take into consideration your scores on Credit Karma a basic evaluate within your credit well being.

New American Funding has become the premier privately owned direct mortgage lenders in the state. The lender delivers competitive fees and lots of loans and customizable personal loan phrases.

A 5-12 months ARM, As an illustration, offers a fastened interest price for 5 decades then adjusts on a yearly basis for that remaining duration in the loan. Commonly the initial mounted interval offers a lower fee, making it beneficial if you propose to refinance or shift prior to the first price adjustment.

Other perks: Some mortgage lenders could supply discount rates for opening more accounts (similar to a examining account). Some others give an online system but nonetheless have Actual physical branches it is possible to take a look at if you want in-particular person provider.

Credit cards may be the most ubiquitous illustration of credit now, allowing for individuals to acquire absolutely anything on credit. The card-issuing bank serves as an middleman involving purchaser and seller, shelling out the vendor in total whilst extending credit to the customer, who may well repay the credit card debt with time whilst incurring desire fees till it's absolutely paid out off.

Tatyana Ali Then & Now!

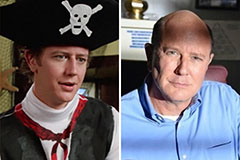

Tatyana Ali Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!